Wednesday, September 29, 2010

Conflict With Tax Brackets

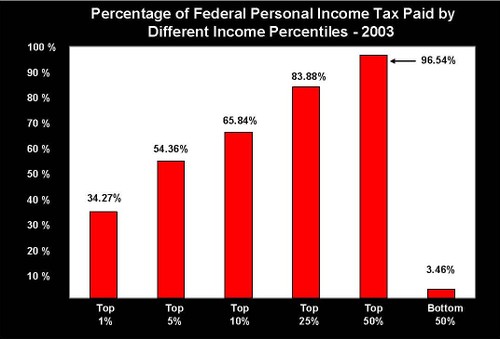

Many people today complain about the way our tax system is designed. The current progressive tax rate, better known as tax brackets, give a higher tax percentage relative to a higher income. Rather than keeping a proportional tax rate, which creates a singular tax percentage to everyone regardless of income. The wealthy suffer more with the progressive tax rate because they are virtually giving up half of their income to the government,while everyone else is paying less than a quarter of their income. Although some may argue that the wealthy have more so they can give more, and others may say that the wealthy won't "suffer" from higher tax rates because they have "enough" money as it is. However, if the tax rate became proportional, the wealthy would still be providing the majority of taxes. Also, the wealthy have worked hard for their money, such as lawyers, who work an average of 80 hours a week, twice an average job's hours; why should it be fair to take away half of their income, while everyone else gets to keep theirs?

Subscribe to:

Posts (Atom)