I found this article with Obama and his economic advisors, where they were debating on the new tax cuts, with the economic advisors suggesting to include the wealthy in the tax cuts, while Obama ignored their opinions. The opinion of a Harvard's economist, Martin Felstein, who served as chairman of the White House Council of Economic Advisors under Ronald Reagan, was over ruled by Obama, with questionable reasons.

"I think the two-year extension would help to keep demand alive at a time when the economy is weak,” Mr. Feldstein told Mr. Obama, “and the notion that it would not continue after that would take some $2 trillion off the size of the national debt at the end of the decade. And that would give a boost to confidence that the administration is really focusing on bringing down the out-year fiscal deficit.”

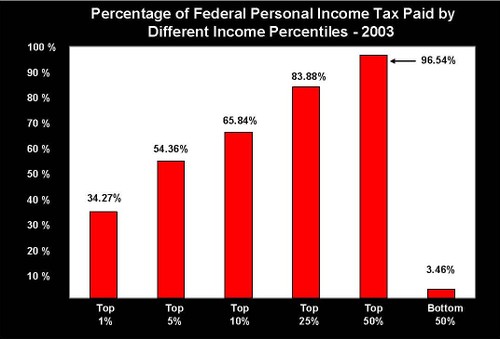

Mr. Obama reiterated his support for extending the tax cuts for families earning less than $250,000, which would be about 98 percent of Americans, arguing that extending them for the 2 percent who make more than that would not generate as much economic benefit since the wealthy would not be as likely to spend the extra money. Two other members of his board, Paul A. Volcker, the chairman, and Laura D’Andrea Tyson, backed him up.

Mr. Feldstein countered: “The impact of the tax increase for the high income who represent, as you say, 2 percent of the taxpayers but about 50 percent of the tax dollars, the impact is one of attitude, confidence.” He added: “So the increase in the tax on those individuals is a signal that the administration – ”

Mr. Obama interrupted. “They have to pay slightly higher taxes,” he said to laughter. That, in other words, was the signal.

http://thecaucus.blogs.nytimes.com/2010/10/04/obama-debates-advisers-on-tax-cuts/?scp=10&sq=tax&st=cse