Competition inspires action and the drive to become the best. Right sided economic structures promote capitalism and therefore, inspires competition. With this type of economy set in place, with little government interference, and no special tax cuts, everyone tries to make a profit, and as big of one as they can. This means that they will do everything they can to make their product more appealing than their competitors, this can be done either by improving their product, or by reducing the price at which it is sold at. Ultimately, making the product as appealing to the customer as possible. As a result, more people will buy that product, and get better value for their dollar. Also, capitalism prevents stagflation, which is inflation that hasn't been antagonized by an action in the economy.

With everyone fighting to earn a buck, they are creating a stronger economy while doing so. Everyone is encouraged to work, and with the competitive nature of the economy, people who slack off, in other words, people who hurt the economy, will suffer.

Monday, November 8, 2010

Tuesday, November 2, 2010

How the Rich Help the Economy

Simply put, the rich help the economy by creating businesses, which provides jobs for society. By being prosperous, a business will gain more money, and with this money, they will expand themselves in order to make more money. While doing this, they create jobs for the public. And if they continue to prosper, they will be able to pay their employees more and will do so to obtain the best possible employees by outbidding the competing companies. This in turn will help set employee by increasing his salary, which will obviously help their financial life.

The next step in a growing company, after obtaining the most valuable employees, will be to improve their products, and make it better than their competitors in the industry. Again.. helping the economy.

The major reason that a country's economy grows is through technological advancements, so that they can use their resources more efficiently than before; in the ultimate goal to narrow the gap between the aggregate demand and the aggregate supply. (The consumers' wants of a good compared to the productions capability to produce set good at the desired price of the consumer)

Then, the business must be able to compete with prices, because no one will buy a product from a business if the quality is the same and the price is higher than another company's. Therefore, the business will lower their prices so they can increase their sales, and ultimately revenue.

This is an ongoing process, which is why the economy continues to grow.

Now, if the rich, the business owners, are to be taxed more heavily than everyone else, this process will be slowed down because they won't be able to afford it, and our economy won't grow as fast, and ultimately suffer. Then there will not be as many jobs, and the average salary won't be as high.

The next step in a growing company, after obtaining the most valuable employees, will be to improve their products, and make it better than their competitors in the industry. Again.. helping the economy.

The major reason that a country's economy grows is through technological advancements, so that they can use their resources more efficiently than before; in the ultimate goal to narrow the gap between the aggregate demand and the aggregate supply. (The consumers' wants of a good compared to the productions capability to produce set good at the desired price of the consumer)

Then, the business must be able to compete with prices, because no one will buy a product from a business if the quality is the same and the price is higher than another company's. Therefore, the business will lower their prices so they can increase their sales, and ultimately revenue.

This is an ongoing process, which is why the economy continues to grow.

Now, if the rich, the business owners, are to be taxed more heavily than everyone else, this process will be slowed down because they won't be able to afford it, and our economy won't grow as fast, and ultimately suffer. Then there will not be as many jobs, and the average salary won't be as high.

Tax the Rich, Not the Workers

This statement has been seen on the back of cars with bumperstickers and seen on signs virtually everywhere in the months leading up to elections. This concept, however, implies that the "rich" don't work, and the workers aren't "rich".

Think of the doctors, the accountants, the lawyers, and the managers of the local Walmart, or the local McDonalds. They can all be considered "rich", yet which one of them slacks off? They all work hard.

They all put in long hours at school, and in their profession so that they can be at where they are today. Lawyers work on average 80 hours a week in their first year; which means that if they were to work six days a week, they would have to work from 6:00am - 7:30pm from Monday through Saturday. Sounds easy enough right?

I'm sure lawyers would love to work standard hours from 9:00am - 5:00 pm for 5 days a week, but in their profession, like other high paying jobs, that is not an option until after 20-25 years of working.

To say that the rich don't work is ridiculous.

The reason that America is wealthier than other countries is that there are so many opportunities for people to become rich. Or, at least there were. By constantly increasing the taxes on the rich, the chances of someone becoming rich are becoming much less likely.

"Central redistribution of wealth was tried in the former Soviet Union and is still in use in EU countries. The former went bankrupt evening out the wealth. The EU is now experiencing the consequences of redistribution: forcing Great Britain to cut back on needed health services and driving Greece into a severe austerity program."

http://www.americanthinker.com/blog/2010/10/tax_the_rich_not_the_workers_m.html

Think of the doctors, the accountants, the lawyers, and the managers of the local Walmart, or the local McDonalds. They can all be considered "rich", yet which one of them slacks off? They all work hard.

They all put in long hours at school, and in their profession so that they can be at where they are today. Lawyers work on average 80 hours a week in their first year; which means that if they were to work six days a week, they would have to work from 6:00am - 7:30pm from Monday through Saturday. Sounds easy enough right?

I'm sure lawyers would love to work standard hours from 9:00am - 5:00 pm for 5 days a week, but in their profession, like other high paying jobs, that is not an option until after 20-25 years of working.

To say that the rich don't work is ridiculous.

The reason that America is wealthier than other countries is that there are so many opportunities for people to become rich. Or, at least there were. By constantly increasing the taxes on the rich, the chances of someone becoming rich are becoming much less likely.

"Central redistribution of wealth was tried in the former Soviet Union and is still in use in EU countries. The former went bankrupt evening out the wealth. The EU is now experiencing the consequences of redistribution: forcing Great Britain to cut back on needed health services and driving Greece into a severe austerity program."

http://www.americanthinker.com/blog/2010/10/tax_the_rich_not_the_workers_m.html

Sunday, October 31, 2010

Obama's Tax Cut Logic..

I was looking into the reasoning behind the tax cuts, which yet again, hurt the wealthy. The 98% of the population that make less than $250,000 a year, will enjoy tax cuts. Therefore leaving the wealthy 2% attacked again by taxes.

I found this article with Obama and his economic advisors, where they were debating on the new tax cuts, with the economic advisors suggesting to include the wealthy in the tax cuts, while Obama ignored their opinions. The opinion of a Harvard's economist, Martin Felstein, who served as chairman of the White House Council of Economic Advisors under Ronald Reagan, was over ruled by Obama, with questionable reasons.

"I think the two-year extension would help to keep demand alive at a time when the economy is weak,” Mr. Feldstein told Mr. Obama, “and the notion that it would not continue after that would take some $2 trillion off the size of the national debt at the end of the decade. And that would give a boost to confidence that the administration is really focusing on bringing down the out-year fiscal deficit.”

I found this article with Obama and his economic advisors, where they were debating on the new tax cuts, with the economic advisors suggesting to include the wealthy in the tax cuts, while Obama ignored their opinions. The opinion of a Harvard's economist, Martin Felstein, who served as chairman of the White House Council of Economic Advisors under Ronald Reagan, was over ruled by Obama, with questionable reasons.

"I think the two-year extension would help to keep demand alive at a time when the economy is weak,” Mr. Feldstein told Mr. Obama, “and the notion that it would not continue after that would take some $2 trillion off the size of the national debt at the end of the decade. And that would give a boost to confidence that the administration is really focusing on bringing down the out-year fiscal deficit.”

Mr. Obama reiterated his support for extending the tax cuts for families earning less than $250,000, which would be about 98 percent of Americans, arguing that extending them for the 2 percent who make more than that would not generate as much economic benefit since the wealthy would not be as likely to spend the extra money. Two other members of his board, Paul A. Volcker, the chairman, and Laura D’Andrea Tyson, backed him up.

Mr. Feldstein countered: “The impact of the tax increase for the high income who represent, as you say, 2 percent of the taxpayers but about 50 percent of the tax dollars, the impact is one of attitude, confidence.” He added: “So the increase in the tax on those individuals is a signal that the administration – ”

Mr. Obama interrupted. “They have to pay slightly higher taxes,” he said to laughter. That, in other words, was the signal.

http://thecaucus.blogs.nytimes.com/2010/10/04/obama-debates-advisers-on-tax-cuts/?scp=10&sq=tax&st=cse

New Proposed Estate Tax

The new proposed estate tax to be effective in January of 2011, takes a large cut at the wealthy. There will be a 50% inheritance tax on any estate valued higher than $1.5 million. This means that if a nephew was to receive a mansion from his uncle valued at $3.5 million, the nephew would also automatically inherit a $1 million US debt. Although this may not concern a large majority of the US population, as they won't have an estate worth more than $1.5 million, it still greatly effects a number of people. Half of the wealthy's estate will go straight to taxes. The immediate family will however not be taxed, yet everyone else will be. With this in place, it will make the wealthy much less inclined to donate large sums to businesses, charities and friends, hurting the economy. Some may argue that they will still have a large amount of money at their disposal; however, losing millions of dollars is still very hurtful, regardless of who you are. Why should it be fair to take away half of their hard earned fortune? Instead, they should no instate this tax, or, if they choose to, they should make it fair to everyone by enforcing an estate tax that affects everyone, instead of targeting the wealthy as always. The wealthy will still be contributing the majority of the tax money, but this way, they aren't the only victims of the tax.

Wednesday, September 29, 2010

Conflict With Tax Brackets

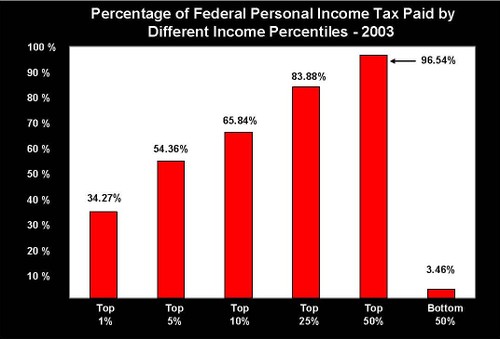

Many people today complain about the way our tax system is designed. The current progressive tax rate, better known as tax brackets, give a higher tax percentage relative to a higher income. Rather than keeping a proportional tax rate, which creates a singular tax percentage to everyone regardless of income. The wealthy suffer more with the progressive tax rate because they are virtually giving up half of their income to the government,while everyone else is paying less than a quarter of their income. Although some may argue that the wealthy have more so they can give more, and others may say that the wealthy won't "suffer" from higher tax rates because they have "enough" money as it is. However, if the tax rate became proportional, the wealthy would still be providing the majority of taxes. Also, the wealthy have worked hard for their money, such as lawyers, who work an average of 80 hours a week, twice an average job's hours; why should it be fair to take away half of their income, while everyone else gets to keep theirs?

Subscribe to:

Posts (Atom)