Sunday, October 31, 2010

New Proposed Estate Tax

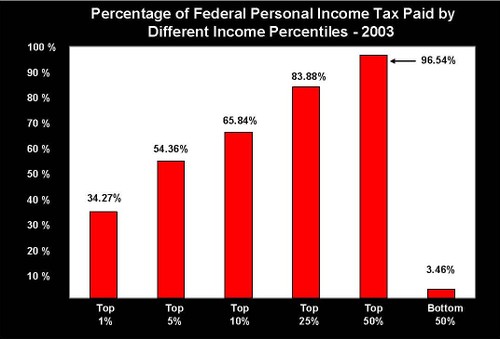

The new proposed estate tax to be effective in January of 2011, takes a large cut at the wealthy. There will be a 50% inheritance tax on any estate valued higher than $1.5 million. This means that if a nephew was to receive a mansion from his uncle valued at $3.5 million, the nephew would also automatically inherit a $1 million US debt. Although this may not concern a large majority of the US population, as they won't have an estate worth more than $1.5 million, it still greatly effects a number of people. Half of the wealthy's estate will go straight to taxes. The immediate family will however not be taxed, yet everyone else will be. With this in place, it will make the wealthy much less inclined to donate large sums to businesses, charities and friends, hurting the economy. Some may argue that they will still have a large amount of money at their disposal; however, losing millions of dollars is still very hurtful, regardless of who you are. Why should it be fair to take away half of their hard earned fortune? Instead, they should no instate this tax, or, if they choose to, they should make it fair to everyone by enforcing an estate tax that affects everyone, instead of targeting the wealthy as always. The wealthy will still be contributing the majority of the tax money, but this way, they aren't the only victims of the tax.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment